Dubai vs Indian real estate 2025

Choosing where to invest your hard-earned money can shape your financial future. For Indian investors, two major markets stand out in 2025—Dubai and India. While India offers familiarity and local control, Dubai attracts attention with high rental yields, zero property tax, and strong capital appreciation potential.

But which market truly delivers better returns? Is Dubai’s luxury real estate a safer bet, or does Indian real estate still hold the edge with its expanding infrastructure and urban growth?

In this detailed comparison, we’ll explore Dubai vs. Indian real estate returns, rental yields, regulatory environment, investment safety, and other key metrics to help you decide where your money should go.

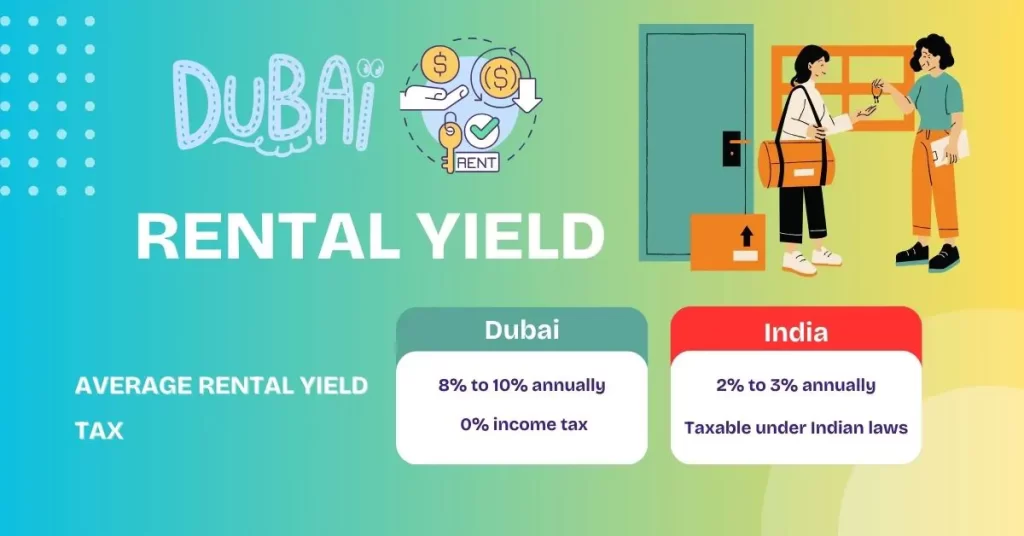

1. Dubai tops the rental yield rankings

Dubai offers a tax-free profit of 8-10% on rental income. On the other hand, in India, only 2-3% of rent is taxed on average, which reduces your actual income.

- Dubai:

- Average rental yield in Dubai ranges between 8% to 10% annually.

- Popular locations like Jumeirah Village Circle, Business Bay, and Dubai Marina often outperform.

- With 0% income tax, investors take home full rental earnings.ess Bay, and Dubai Marina often outperform.

- In India:

- Rental yields in Indian metro cities hover around 2% to 3%, even in prime zones like Mumbai, Bangalore, or Delhi.

- Rental income is taxable under Indian laws, reducing net returns.

- Verdict: Dubai offers up to 3X higher rental income, making it ideal for investors seeking regular passive income.

2. Capital Appreciation: Growth vs. Stability

Dubai sees faster capital growth in key zones (up to 16% annually), while India shows 5–7% appreciation, often slower and location-dependent.

- Dubai:

- Dubai's real estate market has seen strong post-pandemic recovery, with 2023 alone recording a 16% price growth in prime areas.

- Areas like Downtown Dubai and Dubai Hills Estate are in high demand due to infrastructure and tourism boosts.

- In India:

- India’s capital appreciation varies widely. While Tier 1 cities show slow but steady growth (~5–7% annually), Tier 2 cities offer potential but come with longer holding periods and inconsistent demand.

- Delays in possession and lack of RERA enforcement in some states slow returns.

- Verdict: Dubai shows faster capital appreciation in key zones, especially with upcoming projects from developers like Danube, Damac, and Sobha Realty.

3. Regulatory Environment & Investor Protection

Dubai’s RERA ensures investor-friendly regulations and smooth transactions. India’s RERA, though present, faces uneven enforcement across states.

- Dubai:

- Dubai’s Real Estate Regulatory Agency (RERA) ensures transparency and strong legal protection for foreign investors.

- No restriction on 100% ownership in freehold areas.

- Quick property registration (often within a day).

- In India:

- Though RERA brought more transparency, execution varies by state.

- Legal red tape, project delays, and title disputes are still common issues.

- Verdict: Dubai wins for ease of doing business and investor-friendly regulation.

4. Tax Implications: Dubai’s 0% Advantage

Dubai has no property tax, income tax, or capital gains tax, while India imposes multiple taxes, lowering your net property income.

- Dubai:

- No property tax, no capital gains tax, and no income tax on rental earnings.

- Only one-time 4% DLD fee at purchase, with no recurring tax burden.

- In India:

- Rental income taxed based on slab rate.

- Capital gains tax of 20% (after indexation) on long-term holdings.

- Stamp duty and registration charges range from 5–9% depending on state.

- Verdict: Dubai provides full tax efficiency, which significantly boosts net returns.

5. Investment Ticket Size and Affordability

In Dubai, you can own luxury property with flexible plans and visa benefits. In India, similar property values offer fewer incentives and higher EMIs.

- Dubai:

- Studio apartments start from AED 550,000 (~INR 1.2 Cr) in key zones.

- Flexible 1% monthly payment plans and post-handover options from developers like Danube Properties and Damac Properties

- Investors can also qualify for residency visas (Residential Visa at AED 750K, Golden Visa at AED 2M+).

- In India:

- In metros, a 2BHK in a decent area may cost INR 1–2 Cr or more.

- Financing options available, but interest rates are rising.

- No direct residency benefits through property.

- Verdict: Dubai offers better ROI even at similar ticket sizes, with added lifestyle and immigration advantages.

Frequently Asked Questions (FAQs)

Can I invest in Dubai property from India?

Yes, Indian citizens can legally invest in Dubai real estate. Developers and consultants like Aditya Realty offer complete support from India, including bank account setup and visa processing.

Is Dubai real estate safe for long-term investment?

Absolutely. With strong regulatory frameworks, developer accountability, and rising global demand, Dubai remains one of the safest international real estate markets.

Can I get residency by investing in Dubai property?

Yes. Residential Visa is available for AED 750K+ investment; the 10-year Golden Visa is available at AED 2M+.

Which Indian cities give the best property returns?

Currently, Hyderabad, Pune, and Ahmedabad show decent appreciation. However, rental returns still lag behind Dubai.

Which Market Wins?

When comparing Dubai vs. Indian real estate in 2025, the numbers speak for themselves.

| Factor | Dubai | India |

|---|---|---|

| Rental Yield | 8–10% | 2–3% |

| Capital Appreciation | 10–16% | 5–7% |

| Property Tax | 0% | Yes |

| Visa Benefits | Yes | No |

| Investment Safety | High | Moderate |

If you’re looking for higher rental income, tax-free gains, strong legal protection, and global lifestyle benefits, Dubai emerges as the smarter choice—especially with flexible plans and access to residency.

However, if you’re focused on local development or prefer properties within your native region, India still holds emotional and long-term value.

- Smart Investor Tip: Attend a Dubai Property Show in India by Aditya Realty to explore projects and get personalized advice.