In a world where traditional investments are not much more than inflation, savvy investors are turning their attention to Dubai real estate investment, the Middle East’s hottest market. Offering exceptional rental yields, a zero-tax regime, and a booming tourism sector, Dubai is quickly becoming a popular destination for high-return real estate investments.

But what exactly is Dubai rental yield, how is it calculated, and what makes it different from global counterparts like London, New York, or Singapore?

This article takes an in-depth look at the strategies, benefits, risks, and ROI potential of rental property in Dubai. Whether you’re a first-time buyer or an experienced investor, you’ll find data-driven insights and actionable advice that will help you make informed decisions.

Understanding Dubai Property Rental Yield

Before we calculate ROI, we need to understand the rental market. Dubai offers two types of rental income opportunities, Long-term rental & Short-term rental.

- Long-Term Rental (12% ROI)

- In a long-term rental, you lease out your property for a fixed one-year contract.

- This is perfect for families and working professionals.

- The average ROI is 10-12% per year, depending on location and property type.

- Short-Term Rental (16% ROI)

- Short-term rental means your property is managed by a rental management company and operated like a hotel apartment.

- Due to higher demand from tourists & business travelers, this model generates a 14-16% ROI annually.

- Best locations for short-term rentals? Downtown Dubai, Palm Jumeirah, and JBR.

What is Rental Yield and Why it Matters

Rental yield refers to the annual income generated from a property as a percentage of its purchase price. It’s the cornerstone metric for assessing the profitability of any real estate investment.

Formula:

Rental Yield (%) = (Annual Rental Income / Property Purchase Price) x 100

Dubai stands out globally because of its above-average gross rental yields, often ranging from 6% to 20% depending on location, property type, and rental model.

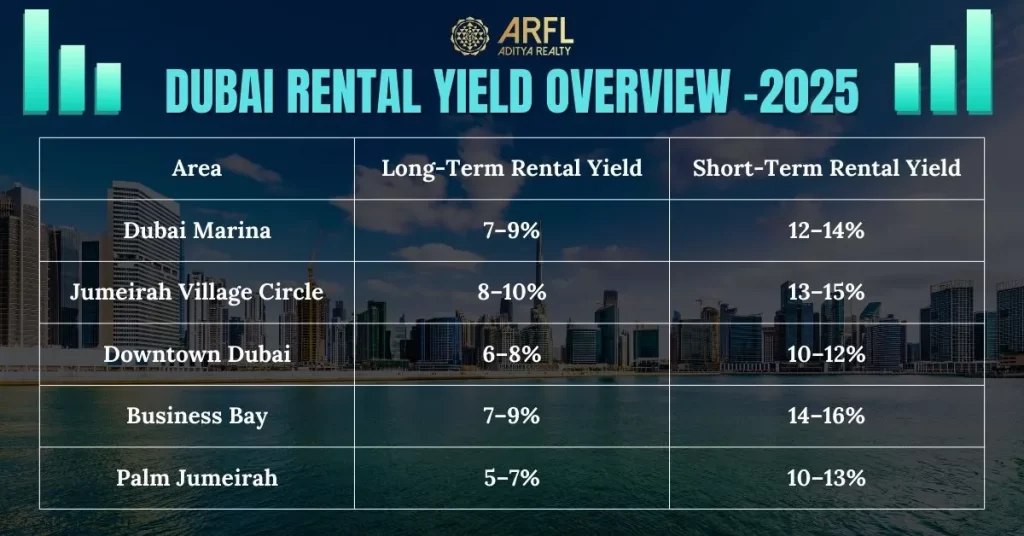

Average Rental Yield in Dubai - 2025

Here’s a quick look at average gross rental yields in Dubai:

| Area | Long-Term Rental Yield | Short-Term Rental Yield |

|---|---|---|

| Dubai Marina | 7–9% | 12–14% |

| Jumeirah Village Circle | 8–10% | 13–15% |

| Downtown Dubai | 6–8% | 10–12% |

| Business Bay | 7–9% | 14–16% |

| Palm Jumeirah | 5–7% | 10–13% |

- Pro Tip:Short-term rentals managed as holiday homes or Airbnb units often generate up to 20% gross ROI, especially during Expo events, New Year’s Eve, and seasonal tourism peaks.

Frequently Asked Questions About ROI in Dubai Real Estate

What makes Dubai's rental yield so high?

Zero property tax and zero rental income tax

Constant influx of expats and tourists

Government-driven infrastructure development

High rental demand with limited premium supply

Is short-term or long-term rental better?

Short-term rentals offer higher ROI (up to 20%) but require professional management.

Long-term rentals provide stable income (10–12%) with fewer headaches.

Choose based on your risk appetite and management bandwidth.

Do I need a residency visa to buy and rent property in Dubai?

- No. Foreigners can own freehold property and earn rental income without UAE residency. However, investments above AED 2 million can qualify you for a 10-year Golden Visa.

Is Dubai real estate safe to invest in?

Absolutely. Dubai has:

Transparent laws

RERA (Real Estate Regulatory Authority) oversight

High liquidity

A stable and business-friendly economy

What are the best areas to invest in for rental yield?

Top performing areas for ROI include:

JVC

Dubai Marina

Business Bay

Downtown Dubai

Arjan

Dubai Hills Estate

Benefits of Investing in Dubai Real Estate for Rental Income

- Tax-Free Profits: No income tax, capital gains tax, or property tax.

- High ROI Potential: Up to 18–20% combining rent + appreciation.

- Capital Appreciation: 6–8% yearly growth in emerging communities.

- Strong Rental Demand: Population growth, tourism, and remote work drive demand.

- Easy Financing: Mortgage options available for non-residents up to 75%.

Actionable Tips for Maximizing Rental Yield in Dubai

Buy in pre-launch or under-construction phases for lower prices and better capital gains.

Use licensed short-term rental management firms to maximize occupancy and earnings.

Invest in 1BHK or studio units — these offer the highest ROI in short-term markets.

Target high-demand tourist areas close to metro stations, beaches, and malls.

Stay updated with local laws (Ejari registration, RERA compliance).

Is Dubai Rental Yield Worth It in 2025?

Without a doubt, Dubai offers one of the best rental yields in the global real estate market. The combination of high rental returns, 0% taxation, booming infrastructure, and investor-friendly laws makes Dubai an irresistible destination for real estate investors in 2025 and beyond.

If you’re planning to generate passive income, diversify internationally, and beat inflation, Dubai should be at the top of your list.

Need expert advice? Contact Aditya Realty for personalized investment solutions tailored for Indian investors.